Can you believe it!!!! No taper!!!!, I was deadly wrong yesterday, after 4 years of no surprise, Bernanke gave market a big party for his departure. S&P 500 up 1.22% on the day, 11 out of 12 days were positive on S&P, market spiked 6.5% in just 12 trading days. That is massive. Now for those you short S&P, EURUSD, AUDUSD, you probably got burned badly, market moved so fast there were no ways so many stop orders can be fill in a second. That;s why I said yesterday, if you are not sure, just don't trade cause No trade is better than bad trade,

Short term no taper could boost market going up a little bit more but longer term this just create more confusion. Now the U.S budget deficit shrink and Treasury didn't need to issue that much debt, at some point Fed will run out of security to buy and they can't buy all the debt Treasury issue, that will create huge distortion in the market and Fed will certainly avoid that scenario. Also, everything in this world has a limit. Fed can't let their balance sheet grow without control, so this just create more and more confusion when will Fed gonna stop? What happened if Fed make lose on those security? How they gonna hike interest rate with such huge balance sheet if condition is necessary ? These questions need to be answered and right now we don't have one. So that's just my take on Fed decision yesterday

S&P 500

Yesterday I went long at 1716, closed at 1727, as I said, 11 out of 12 days were positive, 6.5% in 12 days, momentum could continue but I highly doubt it can sustain it. I put a short entry point at 1730, target 1720 and stop 1735

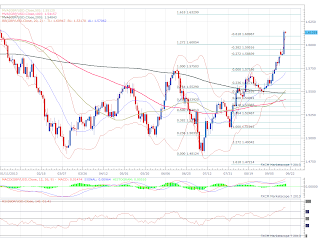

EURUSD

Same story, I immediate went long on no taper news, closed at 13500. Price now broke 13400 resistance level, nest resistance level on the chart is 13700, that's the high we made earlier this year. My sense is we will test that level again, but not today or tomorrow, price is outside bollinger band right and it should correct, I short at 13530, target 13500 and stop 13550

GBPUSD

Overbought, Overbought and Overbought!!! So simple is that, RSI indicated overbought, MACD at top, price outside bollinger band, 4% above 50 days and 100 days moving average. So I went short at 16140, stop 16200 and target 16000

AUDUSD

Since the low at 0.8900. the pair moved 600 pips higher, what a massive move. It just killed all the bears in the market. In the last few days I argued we should see higher Aussie, and it did, price clear 100 days SMA, and it could test 200 days SMA. I know we are some distance away from 200 days SMA, but Aussie is the most volatile G10 currency, you can't rule out that move. Right now I am stay on the sideline.

Foreign Exchange, Option and Futures trading

Wednesday, September 18, 2013

Tuesday, September 17, 2013

Stock market FOMC preview, what you should expect

FOMC is widely expect to taper bond purchase by 10 billion at today's meeting, some say we might get upside surprise, no taper, some say downside surprise, taper by 20 billion. The thing is, Bernanke never really surprise market in the past 4 years. In 2010 market expected QE2 about 600 Billion, he did exactly 600 Billion. In Sep 2011, market expected Operation Twist, he did that as well. In June 2012 market expected Operation Twist 2, he did that as well. In Sep 2012, market expected open ended QE, he did that as well.

So you can see he usually do what the market expected him to do, that's why I don't think we gonna get any surprise today. They key will be market reaction.

Going to this meeting, 12 out of 14 trading days were positive on S&P 500, to some extent you can say this market is overbought. That's the reason I am bearish on S&P, I think market priced in tapering, and this could be the scenario where buy on rumors sell on news.

Now look at the longer term chart below, S&P haven't test 200 days SMA for nearly a year, that's longest bull run in almost 7 years. Why I am saying that? Right now there are lots of bulls out there say S&P could hit 1900, 2000. The thing is market never react positively on monetary tightening and be greedy when other fears, be fears when others greedy. I think today's meeting could mark the beginning of a correction. I could be wrong, but the first rule of trading is preserve your capital, don't take the risk if you don't feel it right, right now I don't feel it right to take risk, remember, no trade is better than bad trade

So you can see he usually do what the market expected him to do, that's why I don't think we gonna get any surprise today. They key will be market reaction.

Going to this meeting, 12 out of 14 trading days were positive on S&P 500, to some extent you can say this market is overbought. That's the reason I am bearish on S&P, I think market priced in tapering, and this could be the scenario where buy on rumors sell on news.

Now look at the longer term chart below, S&P haven't test 200 days SMA for nearly a year, that's longest bull run in almost 7 years. Why I am saying that? Right now there are lots of bulls out there say S&P could hit 1900, 2000. The thing is market never react positively on monetary tightening and be greedy when other fears, be fears when others greedy. I think today's meeting could mark the beginning of a correction. I could be wrong, but the first rule of trading is preserve your capital, don't take the risk if you don't feel it right, right now I don't feel it right to take risk, remember, no trade is better than bad trade

Thanks for your support, and please follow me on Twitter at https://twitter.com/MarketWizard323

or on StockTwits at http://stocktwits.com/MarketWizard323Monday, September 16, 2013

FX market updated 17th/SEP/2013

On Monday FX and stock indices spiked on Summers withdraw news. I called this overreacted on nothing, there were no evidences suggest that Summers is more hawkish than Yellen, and there was no evidence Obama was about to pick Yellen, I really don't understand why market reacted in such way, and remember, history repeat itself over and over again, euphoria usually end badly for the bull!!!!!!

Here is detail analysis

GBPUSD

In the weekend post I argued cable is already topped out and price should decline, well, Monday spiked prove me wrong, if you follow me on twitter or stocktwit, you should know that I short the cable at 1595 and close at 15920. I still remain bearish on GBPUSD, just look at the RSI on daily chart, it indicated overbought and price should correct. However I do recognize reality, there is a probability that price will test 16000 level, my advice is watch out 15950 resistance level, yesterday we failed to advance above that level, today we might test that level again, clear that level we will see 16000, failure to do so should see more downside move

USDJPY

Here is detail analysis

GBPUSD

In the weekend post I argued cable is already topped out and price should decline, well, Monday spiked prove me wrong, if you follow me on twitter or stocktwit, you should know that I short the cable at 1595 and close at 15920. I still remain bearish on GBPUSD, just look at the RSI on daily chart, it indicated overbought and price should correct. However I do recognize reality, there is a probability that price will test 16000 level, my advice is watch out 15950 resistance level, yesterday we failed to advance above that level, today we might test that level again, clear that level we will see 16000, failure to do so should see more downside move

USDJPY

Not much I can said really, range bounce for nearly two weeks, just buy at 99 and sell around 99.5, easy money!!!!!!!

EURUSD

We are set up to test 13400 level, this is the third time we try to break above that level. From my experience, the more it test, the more likely to break, long the EURUSD at 13325, stop 13300, and target 13400

AUDUSD

I said in my weekend post, you cant be too bearish on Aussie, more upside move is more likely and I advice you should long, and that's exactly what happen, not the pair found resistance at 100 days SMA, yesterday I went short at 0.936, and close short at 0.932, made some quick profit. Price is already at upper bollinger band, we should see some correction, but I wont trade this pair until Fed

Tomorrow, I will give you FOMC preview, what you should expect from the Fed, how you should trade it. Thanks for your support, and please follow me on Twitter at https://twitter.com/MarketWizard323

or on StockTwits at http://stocktwits.com/MarketWizard323Saturday, September 14, 2013

FX market weekend update 14th/SEP/2013

EURUSD

Throughout this week I argued we should see EURUSD if you read my post, and its exactly what happened. The pair now trading at 13294. I still think there are some momentum to the upside. I prefer to long at this point, target 13350 and stop 1325. The story of next week will be Fed, I don't think we will see any volatility until Wed.

GBPUSD

In the last few trading sessions I repeatedly said don't try to short the cable just yet, cause momentum to the upside seems very strong. I was right about it, and now, its time to short the GBPUSD!!!. If you follow me on Twitter or StockTwits, you knew I went short on Friday at 15855, target 15780 and stop 15900. I think the market already priced in lots of good news and market seems priced in first rate hiked by 2014. So I don't think there aren't many upside left, I might be wrong on this one, but the question you should ask yourself is , do you really want to long at this point?

USDJPY

Nothing really changed on Yen lately, resistance at 100 level and support at 99 level, just play the game, long at 99 area and sell at 100 area. Yen will continue range bounce until Fed

AUDUSD

Since September sentiment shifted to bullish on Aussie, last two days we saw some correction as Australian Jobs number came at worse than expected and metal price declined. I am still bullish on the Aussie right now, Chinese economy seems stabilized and Australian Liberal Party are very pro business, that should support the Aussie going forward. However, I set up a long at 0.9200, target 0.925 and stop 0.918

GOLD

Sentiment on gold was so bearish lately, major banks downgrade their target one after another, Fed tapering put even more pressure on gold. Having said that, I suspect the Gold is pretty much priced in Fed tapering, I am not entirely sure but sentiment was so bearish and I really doubt there is any downside left. I set up a long entry at 1300, target 1350 and stop 1275

Market move all the time and I only have time to update my post once a day, so if you like my post, please follow me on Twitter at https://twitter.com/MarketWizard323

or on StockTwits at http://stocktwits.com/MarketWizard323

I am just a trader try to share information and that's it, so I would love your support and thanks for reading my post.

Market move all the time and I only have time to update my post once a day, so if you like my post, please follow me on Twitter at https://twitter.com/MarketWizard323

or on StockTwits at http://stocktwits.com/MarketWizard323

I am just a trader try to share information and that's it, so I would love your support and thanks for reading my post.

Thursday, September 12, 2013

FX market updated 13th/SEP/2013

USDJPY

I said in my yesterday's post play the Ping Pong games on USDJPY, and that's exactly what happened, you sold at 100, you bought at 99. I don't think this pair will move significantly until Fed meet next week. So my advice, buy sub 100, sell above 100.

EURUSD

Not doing much in the past few trading days, resistance coming at 13325 support coming at 13275, I don't think EURUSD will do much before Fed meeting. Buy the dips at 13275, and sell the rally at 13300, that's my advice.

GBPUSD

Who would thought UK's economy finally getting to the escape velocity. Before Mark Carney came in, everyone expected him to show some magic to saved the economy, now, looks like he might tighten the monetary policy sooner than everyone expected. The cable now trading at 7 months high, I am not sure this is the top or not, I said yesterday I will stay on the sideline for now, and that's what I am gonna do.

AUDUSD

The horrible jobs number in Australian stopped the rallied, the pair found support at 0.9232, looks like we will test that level again at some point today, break that level will see more downside move. My feeling is the more you test the level, more likely it will break

GOLD

Gold getting weaker and weaker, yesterday the price broke 1334 support. No war on Syria, weak India Rupee, Fed tapering. Gold just cannot catch a break, I think it will test 1300 support. However, at this point, Gold is pretty much priced in Fed tapering, I don't think the gold will dropped further if Fed reduce QE, I will set up a long position at 1300, stop 1280 and target 1350

I said in my yesterday's post play the Ping Pong games on USDJPY, and that's exactly what happened, you sold at 100, you bought at 99. I don't think this pair will move significantly until Fed meet next week. So my advice, buy sub 100, sell above 100.

EURUSD

Not doing much in the past few trading days, resistance coming at 13325 support coming at 13275, I don't think EURUSD will do much before Fed meeting. Buy the dips at 13275, and sell the rally at 13300, that's my advice.

GBPUSD

Who would thought UK's economy finally getting to the escape velocity. Before Mark Carney came in, everyone expected him to show some magic to saved the economy, now, looks like he might tighten the monetary policy sooner than everyone expected. The cable now trading at 7 months high, I am not sure this is the top or not, I said yesterday I will stay on the sideline for now, and that's what I am gonna do.

AUDUSD

The horrible jobs number in Australian stopped the rallied, the pair found support at 0.9232, looks like we will test that level again at some point today, break that level will see more downside move. My feeling is the more you test the level, more likely it will break

GOLD

Gold getting weaker and weaker, yesterday the price broke 1334 support. No war on Syria, weak India Rupee, Fed tapering. Gold just cannot catch a break, I think it will test 1300 support. However, at this point, Gold is pretty much priced in Fed tapering, I don't think the gold will dropped further if Fed reduce QE, I will set up a long position at 1300, stop 1280 and target 1350

Wednesday, September 11, 2013

FX market updated 12th/09/2013

EURUSD

I said in Monday post that sentiment in Eurozone was turning positive and I made a call the $EURUSD should go higher, and it did, the pair now trading at 13325, not far away from resistance level 13340. For those of you long the pair, you made great profit like I did, but don't get too greedy. FOMC will meet next week and decide whether to taper or not, I don't think EURUSD will go much higher before the meeting. I set up a short entry at 13340, target 13290 and stop 13370.

GBPUSD

My weekend post argued that UK economy was improving and we should see GBPUSD go higher, it did and exceed my expectation, On Tuesday I argued the good news was priced in and I shorted the pair at 15710, that didn't work out well, I stopped at 15745. I am not so sure how far this pair will go, sentiment is very important in FX market, right now there are many traders turn positive on the pound and it could go much higher. I don't want to long or short at this point, stay on the sideline and see how the market will go

USDJPY

On Monday I argued we will break 100 level and it did, I said price need to clear 100.25 level convincingly before it can move much higher, and it did not. Th pair is just range bounce now, should see support around 99.5 resistance 100.25. The thing is I don't think Japaneses want to see their currency weaken to 110 or 120 like other commentator said, that make no sense, Japaneses import lots of raw material for their manufacturing business, they don't want to see the Yen weaken so much to see their cost spike. Having said that, nor do they want to see Yen strength to level like below 90. So my advice, sell at 101 area and buy at 99 area, play the Ping Pong games !!!!!!

AUDUSD

You know what, the rallied we saw on Aussie is completely short covering, net short position on the pair reached record in last few weeks, major investment banks like UBS made some ridiculous that Aussie will drop to 0.85, when market are too short and too negative, price rebound. So simple is that. Price could still go higher from this point, but not much before the FOMC next week, I will short at 0.936, stop 0.938 and target 0.93

If you like my post, please follow me on Twitter at https://twitter.com/MarketWizard323

or on StockTwits at http://stocktwits.com/MarketWizard323

Thanks for your support

I said in Monday post that sentiment in Eurozone was turning positive and I made a call the $EURUSD should go higher, and it did, the pair now trading at 13325, not far away from resistance level 13340. For those of you long the pair, you made great profit like I did, but don't get too greedy. FOMC will meet next week and decide whether to taper or not, I don't think EURUSD will go much higher before the meeting. I set up a short entry at 13340, target 13290 and stop 13370.

GBPUSD

My weekend post argued that UK economy was improving and we should see GBPUSD go higher, it did and exceed my expectation, On Tuesday I argued the good news was priced in and I shorted the pair at 15710, that didn't work out well, I stopped at 15745. I am not so sure how far this pair will go, sentiment is very important in FX market, right now there are many traders turn positive on the pound and it could go much higher. I don't want to long or short at this point, stay on the sideline and see how the market will go

USDJPY

On Monday I argued we will break 100 level and it did, I said price need to clear 100.25 level convincingly before it can move much higher, and it did not. Th pair is just range bounce now, should see support around 99.5 resistance 100.25. The thing is I don't think Japaneses want to see their currency weaken to 110 or 120 like other commentator said, that make no sense, Japaneses import lots of raw material for their manufacturing business, they don't want to see the Yen weaken so much to see their cost spike. Having said that, nor do they want to see Yen strength to level like below 90. So my advice, sell at 101 area and buy at 99 area, play the Ping Pong games !!!!!!

AUDUSD

You know what, the rallied we saw on Aussie is completely short covering, net short position on the pair reached record in last few weeks, major investment banks like UBS made some ridiculous that Aussie will drop to 0.85, when market are too short and too negative, price rebound. So simple is that. Price could still go higher from this point, but not much before the FOMC next week, I will short at 0.936, stop 0.938 and target 0.93

If you like my post, please follow me on Twitter at https://twitter.com/MarketWizard323

or on StockTwits at http://stocktwits.com/MarketWizard323

Thanks for your support

Tuesday, September 10, 2013

Fed taper put cloud on gold

Gold price continue to decline after the bounced on Friday Non farm payroll number, gold struggled to break above 1400 level and now it just broke 1372 key support level. Frankly I don't see any support until 1360, the 100 days SMA as the graph below indicated. I don't think we will see any meaningful rally until Fed decision on QE, its very interesting to note that Bond market is pretty much already priced in Fed taper, Gold looks undecided at this point, Equity market, however rallied as they believed the Friday's Jobs number will stop Fed tapering.

Only one can be true, my feeling is Equity market got this complete wrong, Fed will taper and I think Equity will suffer, bond market wont have a huge reaction as it already priced in. Gold, hmm, I am not sure at this point, I will buy it if the price drop below 1330, I will sell any rally above 1400 before the Fed

Only one can be true, my feeling is Equity market got this complete wrong, Fed will taper and I think Equity will suffer, bond market wont have a huge reaction as it already priced in. Gold, hmm, I am not sure at this point, I will buy it if the price drop below 1330, I will sell any rally above 1400 before the Fed

Subscribe to:

Comments (Atom)

.png)

+(-).png)