Can you believe it!!!! No taper!!!!, I was deadly wrong yesterday, after 4 years of no surprise, Bernanke gave market a big party for his departure. S&P 500 up 1.22% on the day, 11 out of 12 days were positive on S&P, market spiked 6.5% in just 12 trading days. That is massive. Now for those you short S&P, EURUSD, AUDUSD, you probably got burned badly, market moved so fast there were no ways so many stop orders can be fill in a second. That;s why I said yesterday, if you are not sure, just don't trade cause No trade is better than bad trade,

Short term no taper could boost market going up a little bit more but longer term this just create more confusion. Now the U.S budget deficit shrink and Treasury didn't need to issue that much debt, at some point Fed will run out of security to buy and they can't buy all the debt Treasury issue, that will create huge distortion in the market and Fed will certainly avoid that scenario. Also, everything in this world has a limit. Fed can't let their balance sheet grow without control, so this just create more and more confusion when will Fed gonna stop? What happened if Fed make lose on those security? How they gonna hike interest rate with such huge balance sheet if condition is necessary ? These questions need to be answered and right now we don't have one. So that's just my take on Fed decision yesterday

S&P 500

Yesterday I went long at 1716, closed at 1727, as I said, 11 out of 12 days were positive, 6.5% in 12 days, momentum could continue but I highly doubt it can sustain it. I put a short entry point at 1730, target 1720 and stop 1735

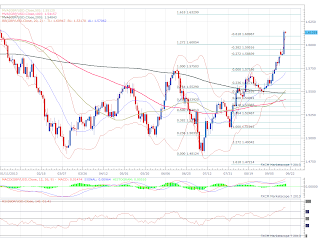

EURUSD

Same story, I immediate went long on no taper news, closed at 13500. Price now broke 13400 resistance level, nest resistance level on the chart is 13700, that's the high we made earlier this year. My sense is we will test that level again, but not today or tomorrow, price is outside bollinger band right and it should correct, I short at 13530, target 13500 and stop 13550

GBPUSD

Overbought, Overbought and Overbought!!! So simple is that, RSI indicated overbought, MACD at top, price outside bollinger band, 4% above 50 days and 100 days moving average. So I went short at 16140, stop 16200 and target 16000

AUDUSD

Since the low at 0.8900. the pair moved 600 pips higher, what a massive move. It just killed all the bears in the market. In the last few days I argued we should see higher Aussie, and it did, price clear 100 days SMA, and it could test 200 days SMA. I know we are some distance away from 200 days SMA, but Aussie is the most volatile G10 currency, you can't rule out that move. Right now I am stay on the sideline.

No comments:

Post a Comment